VOLUNTARY LIFE/AD&D

THIS ENROLLMENT PAGE IS FOR EMPLOYEES WHO

WISH TO PURCHASE SUPPLEMENTAL LIFE/AD&D

- In addition to the employer-paid Basic Life/AD&D -

First things first...

Do I need to complete a health statement?

READ through four scenarios to determine if you are required

to complete a health statement - Evidence of Insurability (EOI):

-

You were hired after 9/15/25, it’s your first open enrollment period ( with 1/01/26 effective date), you may elect the Guaranteed Issue Amount of 150K - NO EOI Required

-

You already have 150k of Voluntary Life benefit, at open enrollment period (1/01/26 effective date) you may elect an additional 20k, and you will now have 170k benefit, - NO EOI Required

-

You already have 150k of Voluntary Life, at open enrollment period (1/01/26 effective date) you may purchase the max 500K benefit - if over 20K increment - YES, EOI Required

-

You went through previous open enrollment and declined the Guaranteed Issue amount of 150k, at open enrollment period (1/01/26 effecitve date) you may now decide you would like a benefit that’s over 20k - YES, EOI Required

In other words, if you are requesting a benefit amount greater than the Guaranteed Issue amount, have previously waived Voluntary Life, or are increasing the coverage amount,

you are required to complete the Evidence of Insurability form below.

ENROLL BELOW AND THEN SEND COMPLETED EOI FORM TO: groupbenefitsadmin@principal.com

How much will it cost?

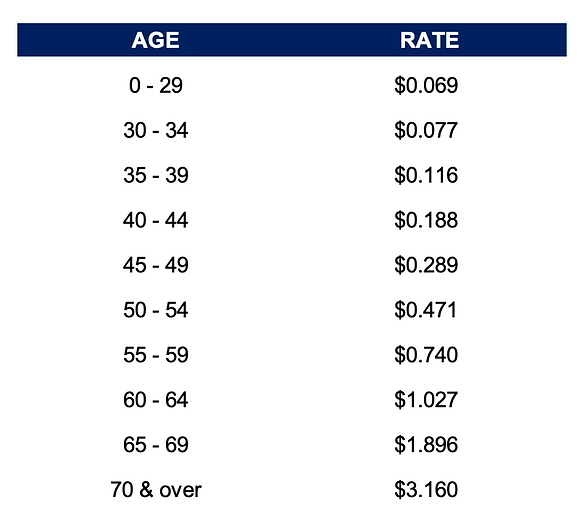

Supplemental (VOLUNTARY) Life/AD&D is available to purchase through your employer. Pricing for both employee and spouse is based on Age/Rate grid below.

Your per pay period deduction is calculated as follows using the

Age/Rate grid below:

Step 1: Find EMPLOYEE Age Bracket and Rate

Step 2: Consider COVERAGE AMOUNT you wish to purchase ($500,000 Maximum Benefit / $150,000 Guaranteed Issue without Evidence of Insurability completed / $20,000 Increment Guaranteed Issue - see scenarios above)

Step 3: Multiply Employee COVERAGE AMOUNT by age-banded RATE = Gross amount

Step 4: Divide GROSS AMOUNT by 1000 = Monthly Rate

Step 5:

Biweekly Employees:

Multiply MONTHLY RATE by .4615 = Pay Period Deduction (biweekly)

Should you have any questions, please contact your Human Resources Manager, MaryPat Pohlig at (203) 792-4515 x1121.